| HELLO!

Summer is now in full swing, so hopefully you’re out enjoying the sunshine and new adventures. If you’re staying close to home and have projects in the works, feel free to reach out if you need recommendations for pros who can give you a hand. It would be great to catch up! Of course, if you or anyone you know is interested in making a big move, help is just a phone call away!

|

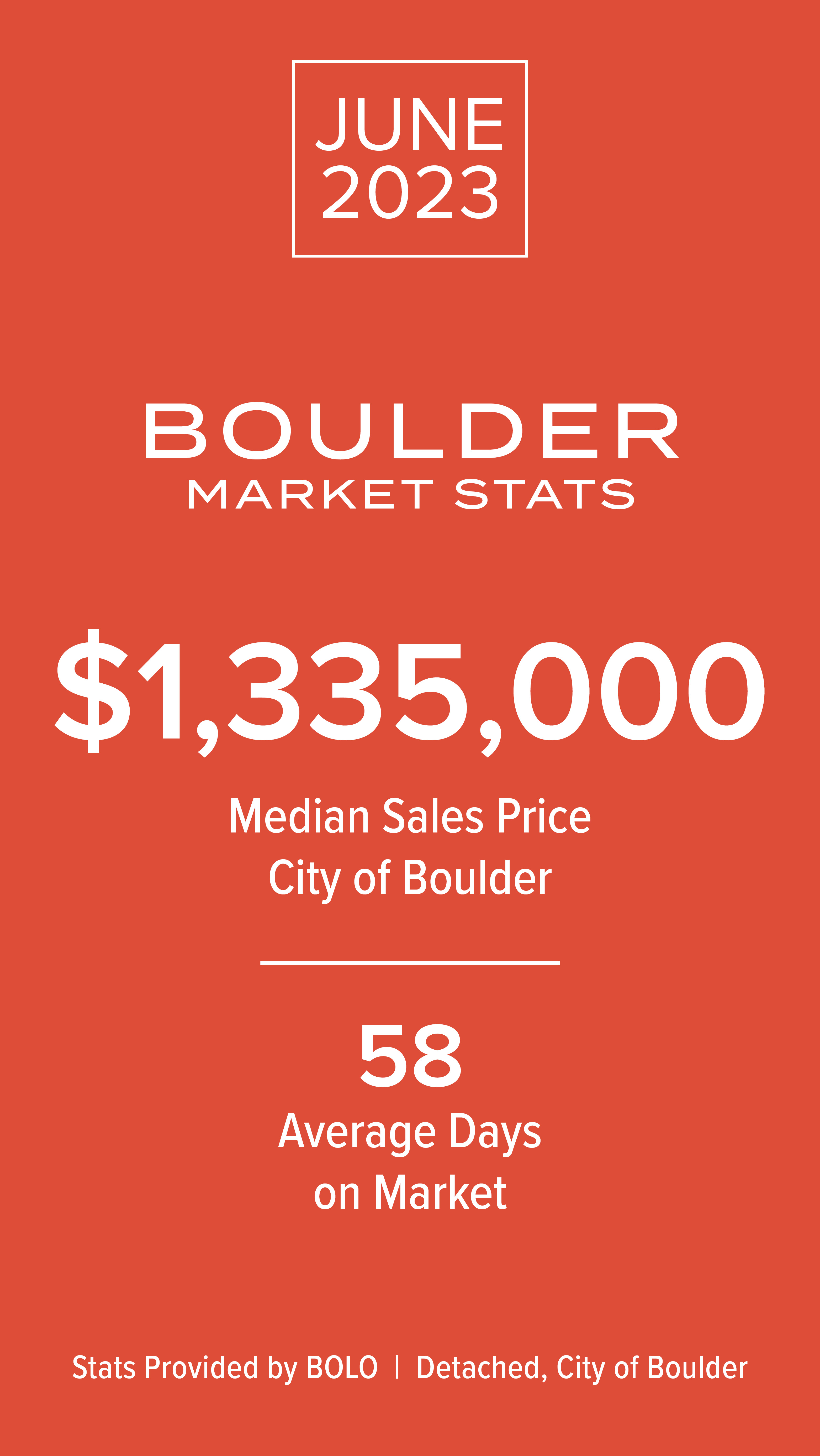

A LOOK AT THE MARKET

In the city of Boulder, single-family home sales were up and the median price actually increased from $1,307,500 in May to $1,335,000 in June. While this is good news for current sellers, buyers are paying 6% less than the prior year.

CLICK HERE to learn more or reach out to discuss your real estate needs.Homes still available for sale at the end of the month also ticked down slightly to 3.7 months of inventory. That's still up 76.2% year-over-year and more than halfway to the balanced market mark. Days on market also jumped significantly from 46 in May to 58 in June. As for Boulder County as a whole, the median price decreased again, coming in at $839,000 for June. One bright spot was Lafayette where prices jumped month-over-month, increasing from $825,000 in May to $890,000 in June. Broomfield County also experienced a price surge. |

| BEST STAYCATION IDEAS IN DENVER & BOULDER

Staycations are popular and for good reason. It’s a great way to relax, read a book, even camp in your own backyard. You can also take on easy DIY projects like painting an accent wall, creating a vertical garden, or updating those ubiquitous, builder-grade dome lights.

CLICK HERE for even more ideas and the best local spots for a great staycation.If you want to venture beyond home, book a weekend at the historic Brown Palace Hotel and Spa in Denver or enjoy rustic-chic accommodations by staying a night or two at Basecamp Boulder. Once you’re done with book reading, head to a local day spa such as Woodhouse in Denver or Spavia Boulder for a rejuvenating massage. Swim, fish, or SUP at Chatfield State Park or Union Reservoir. The Front Range also has tons of museums to explore. |

| WHAT DEBT-TO-INCOME RATIO DO YOU NEED FOR A MORTGAGE?

Debt-to-income ratio, or DTI, is your total monthly debt payments divided by your gross monthly income (before taxes) and tells lenders how much of a mortgage payment you can afford.

CLICK HERE to learn more about DTI & how to make mortgage approval easier.

Different loan programs have different debt-to-income ratio (DTI) requirements, so a lot comes down to the type of loan you hope to get. Guidelines for the most common loan programs are: • Conventional loans: 50% • FHA loans: 50% • VA loans: 41% • USDA loans: 43% A good rule of thumb is that the lower your DTI, the better your chances are of getting approved –and the more money you may be able to borrow. IN COLLABORATION WITH

NMLS ID #2289

|

|||

PORCHLIGHT FEATURED LISTINGS

|

|||

|